- All Plans

- Yahoo Press Release

- Bloomberg Press Release + Yahoo Finance

- Business Insider Press Release

- Benzinga Press Release

- Digital Journal Press Release

- US Times Now Press Release

- AP News Press Release

- Yahoo Finance Press Release

- Street Insider Press Release

- MSN News Press Release

- USA Today Press Release

Payouts.com Brings Essential Tools for Streamlining Vendor Management and Payments

When managing vendors and handling accounts payable, it’s essential to have a reliable, streamlined system that enhances financial clarity and minimizes manual work. With effective automation solutions, you can manage vendor interactions seamlessly, improve payment efficiency, and reduce administrative overhead. My recommendations are based on observing industry trends and knowing the challenges businesses face in vendor management and payment automation. With tools like Payouts.com, you can drive efficiency and maintain solid financial partnerships with vendors.

The Value of a Comprehensive Vendor Portal

One of the most efficient ways to improve vendor relations is through a robust vendor portal. For instance, tools like the manage vendor portal provide a centralized platform where businesses can access analytics, manage transactions, and communicate with vendors in real-time. This portal consolidates all vendor-related tasks, helping companies streamline operations, ensure compliance, and gain a transparent view of each vendor’s payment status. Such a portal is an asset for any business aiming to build transparent, long-term vendor relationships.

The portal includes features like personalized vendor profiles, allowing companies to maintain comprehensive records of past interactions and essential compliance documents. It also provides vendors with self-service tools, reducing the need for constant back-and-forth and empowering them to track their own payment statuses. This efficiency fosters trust and stability, critical factors in maintaining productive vendor partnerships.

AP Automation for Reducing Manual Efforts

Accounts payable (AP) automation has become essential for businesses to streamline invoice processing, increase accuracy, and improve cash flow. Solutions like AP automation help companies automate invoice capture and matching, integrating seamlessly with existing accounting software. By reducing manual errors and providing real-time spend visibility, businesses can make informed financial decisions and ensure accurate records. This automation simplifies the AP process, allowing finance teams to focus on strategic initiatives rather than routine tasks.

With intelligent invoice capture and matching, AP automation software minimizes the risk of inaccuracies, enabling faster invoice approvals and reducing overall processing time. Businesses using this technology benefit from enhanced financial oversight, as well as improved relationships with vendors, who receive timely and accurate payments.

Benefits of Payout Automation for Efficient Transactions

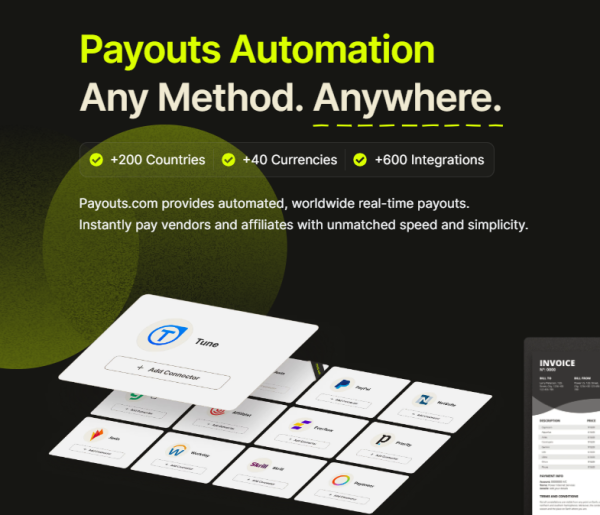

In addition to vendor and AP management, businesses can benefit greatly from payouts automation solutions that ensure secure, real-time transactions. A reliable payout automation tool enables companies to make instant, cross-border payments to vendors and affiliates. This capability is vital for businesses with global operations, as it eliminates delays in payment processing and supports transactions in multiple currencies, including both fiat and crypto.

This service not only reduces the financial strain on vendors but also provides businesses with enhanced liquidity management options, allowing them to maintain a consistent cash flow. Instant payouts reinforce a business’s reputation for reliability and operational efficiency, encouraging vendors to engage in continued and successful partnerships.

Why Choose a Trusted Platform for Vendor and Payment Automation

Selecting the right platform for vendor and payment automation is a crucial decision that can significantly affect a business’s operational efficiency and financial visibility. Trusted platforms like Payouts.com offer an extensive suite of tools, from vendor management to advanced payment systems, all designed to support compliance, reduce administrative load, and improve vendor relations. With integrated systems that support multiple currencies and connect with popular accounting software, these platforms provide a scalable solution tailored to evolving business needs.

In conclusion, the adoption of vendor management and AP automation tools is no longer optional but a necessary step for modern businesses aiming to stay competitive. By choosing an experienced provider with a robust suite of tools, you can optimize your vendor interactions, ensure compliance, and maintain seamless financial operations.

Media Contact

Organization: Payouts

Contact Person: Leor Ceder

Website: https://payouts.com/

Email: Send Email

City: Herzliya

Country: Israel

Release Id: 16112420057