- All Plans

- Yahoo Press Release

- Bloomberg Press Release + Yahoo Finance

- Business Insider Press Release

- Benzinga Press Release

- Digital Journal Press Release

- US Times Now Press Release

- AP News Press Release

- Yahoo Finance Press Release

- Street Insider Press Release

- MSN News Press Release

- USA Today Press Release

Insolifys FinCore and Safi FI Are Redefining the Future of Banking and Financial Intelligence

Nairobi, Kenya, 2nd Sep 2025 – In an industry of finance under siege to automate, cut expenses, and cater to skyrocketing customer needs, Insolify is raising the new global standard with its award-winning flagship product, FinCore, and the newly released Safi FI (Financial Intelligence) system.

Shaping the Future of Financial Institutions

Together, they symbolize a deep change in the way banks, fintechs, and financial institutions do business from the foundation of their infrastructure to the smartness customers feel on a daily basis.

FinCore: The Tried-and-Tested Backbone of Contemporary Banking

Already established in market and driving institutions throughout EMEA, FinCore is not only a core banking system, it is a comprehensive operating environment for financial institutions.

AI-Powered Automation for Trim Operations

FinCore enables banks, fintech businesses, loan businesses, and finance houses to operate their processes smoothly with up to 80% fewer employees, due to profound AI-powered automation and proprietary technology developed from decades of banking and enterprise systems expertise. From loan origination to loan processing, deposits, general ledger accounting, and compliance reporting, FinCore automates the drudgery of financial processes. This empowers institutions to concentrate on what counts: growth, customer service, and innovation.

FinCore as a Reliable Industry Powerhouse

“FinCore is no experiment, it’s an established engine already in production in the field,” stated a Senior Engineer at Insolify Ai research labs. “We built it to strip away the complexity that has so long characterized banking technology. With FinCore, institutions can introduce new services, grow quickly, and stay regulator-ready while cutting overhead exponentially.”

Meet Safi FI: Financial Intelligence for Customers

While FinCore streamlines institutional processes, Safi FI brings smarts to the customer’s fingertips. Introduced today, Safi FI is a small, on-device AI model that any fintech or bank can easily integrate into their mobile apps and instantly turn them into intelligent financial helpers.

Real-Time Spending Insights and Financial Health

Safi FI can read spending in real time and tell customers right away how they are using their money and how they can get healthier financially. It accurately budgets and forecasts cash flow and provides individualized guidance on savings, investments, and long-term financial planning. In addition to analysis, it also handles the day-to-day minutiae of financial life, from organizing payments for bills to alerting customers about near future subscriptions, and keeping them out of late charges and surprise fees.

Fraud Detection and Data Privacy at Scale

Most significantly, perhaps, Safi FI builds trust and security through detecting potential fraud and scam behavior in milliseconds, enforcing facial verification, pattern matching, flagging suspicious activity before it has a bearing on the customer. And since everything is processed locally on the user’s device, sensitive information never touches their phone, preserving privacy without compromising speed or intelligence. Safi FI is the first such one, a sustainable, trustworthy, and worldwide scalable solution that is especially potent in low-connectivity areas.

Safi: Africa’s AI Powerhouse

Safi FI is driven by Safi, the proprietary AI model of Insolify built in 2022. Safi is already creating ripples across sectors as one of the world’s first African-developed large language models with vision and real-time understanding of language that can converse naturally in Hausa, Igbo, Yoruba, Pidgin, Swahili, Xonga, and many others.

Inclusive AI for Global Financial Services

Applied extensively in customer care, fraud detection, and staff support, Safi has emerged as a trustworthy and inclusive application. With Safi FI, the model enters the realm of financial intelligence, providing not only transactional assistance but also personalized financial advising and insight. To millions of customers, this implies that their daily banking app can now act as a financial coach, a fraud protector, and a trusted advisor all in one in the palm of their hand.

Building Trust Through Intelligence

The combination of FinCore’s operational backbone and Safi FI’s customer-facing intelligence presents a new model for global finance. Institutions can now run lean, AI-augmented operations while giving their customers hyper-personalized, privacy-first experiences.

Industry Insights from Insolify Engineers

“Banking isn’t just transactional anymore, it’s about establishing trust through smarts,” Billah Muayyat, an Executive and an Engineer at Insolify highlighted. “Insolify is providing both sides of the coin with FinCore and Safi FI: institutionally efficient infrastructure and smart financial experiences for customers.”

Leadership Driving Innovation

Billah Muayyat, Insolify’s Chief Engineer, is a software, AI, and fintech visionary with a passion to minimize the friction of payments and financial management in Africa, Europe, and the Middle East. His thought leadership, experience, and his unfaltering quest for simplicity in finance have driven Insolify’s innovations, earning the company its position as a global financial infrastructure leader.

Positioned for Global Impact

Insolify solutions are currently in production with institutions in Nigeria, Kenya, and South Africa, with new expansion in the Middle East and Europe. With its twin emphasis on scale automation and on-device intelligence, the company is being identified as a leader of the next generation of financial technology.

Industry Recognition and Future Model

Industry watchers opine that Insolify’s strategy will shortly emerge as the model of the future for financial institutions: leaner banking, faster fintechs, and smarter finance that is inclusive and reliable.

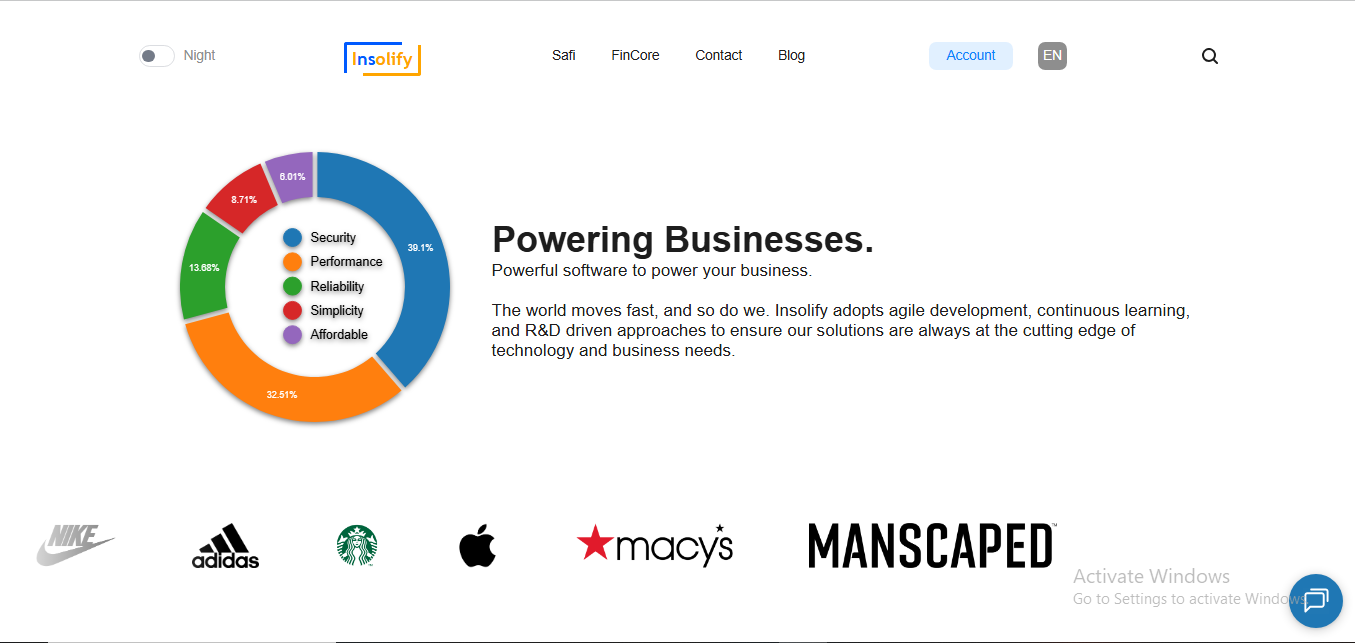

About Insolify

Insolify is an intelligence and infrastructure firm defining the future of finance. Its leading platform, FinCore, is a cloud native core banking platform that empowers financial institutions to run in perfect harmony with AI powered automation and low overhead. Its newest development, Safi FI, is a lean, on-device financial intelligence framework that introduces real-time financial guidance and planning directly into mobile applications.

Mission for Global Intelligent Finance

Operating in EMEA, Insolify’s vision is to combine African creativity with world standards, creating the next generation of trusted, smart finance.

Company Details

Organization: Insolify

Contact Person: Billah Muayyat

Website: https://insolify.com/

Email: sales@insolify.com

Country: Kenya

Release Id: 02092533351