- All Plans

- Yahoo Press Release

- Bloomberg Press Release + Yahoo Finance

- Business Insider Press Release

- Benzinga Press Release

- Digital Journal Press Release

- US Times Now Press Release

- AP News Press Release

- Yahoo Finance Press Release

- Street Insider Press Release

- MSN News Press Release

- USA Today Press Release

NexMetals Mining Raises $80 Million Securing Title on Two Botswana Critical Metal Projects

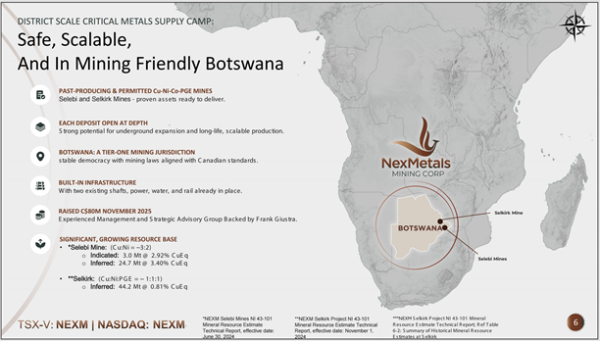

On December 3, 2025 NexMetals Mining confirmed that it now has unencumbered title to both the Selebi and Selkirk copper, nickel, cobalt and platinum group element (“Cu-Ni-Co-PGE“) assets.

NexMetals Secures Botswana Assets

Vancouver, BC, December 3, 2025 – Global Stocks News – Sponsored content disseminated on behalf of NexMetals Mining. On December 2, 2025, NexMetals Mining (TSXV: NEXM) (NASDAQ: NEXM) confirmed it now holds unencumbered title to both the Selebi and Selkirk copper, nickel, cobalt, and platinum group element (“Cu-Ni-Co-PGE“) assets.

This milestone follows NEXM’s recent equity financing, which raised CDN $80 million at $5.70 per unit. Texas-based Condire Investors LLC (Condire) led the order. NexMetals owns two previously producing Cu-Ni-Co-PGE mines in Botswana, a safe, mineral-rich Tier 1 mining jurisdiction in Africa.

Condire focuses on commodities, including energy, precious, and base metals. The firm manages assets totaling approximately $1.2 billion, according to its March 2025 Form ADV.

“The strong support from both new and existing institutional investors, including Condire as a new 9.9% shareholder, reflects the progress we have made over the past two quarters in strengthening the company,” stated NEXM CEO Morgan Lekstrom in the November 17 press release.

Debt Reduction And Financing

“We are deleveraging the balance sheet, advancing our assets, and meeting our strategic objectives,” added Lekstrom.

The CAD $80 million raise allows NEXM to cover a US $25 million contingent milestone payment, securing titles for both Selebi and Selkirk and accelerating project derisking.

“This financing increases institutional ownership from 30% to 75% and eliminates legacy debt that previously created market overhang,” stated Crux Investor.

In a November 19, 2025 Crux Investor interview, CEO Morgan Lekstrom discussed NEXM’s near- and medium-term objectives.

“When our team joined, the company had $21 million in debt. We faced a $35 million Canadian payment. We cleared the debt, converted it to equity, and brought in a new 9.9% shareholder, Condire. EdgePoint, our shareholder, contributed $9 million. About 97% of our book came from long-only institutions,” he explained.

Selebi Metallurgical Breakthrough

On September 3, 2025, NexMetals announced a significant metallurgical break-through at its past-producing Selebi Mines in Botswana.

The underground Selebi Mines operated from 1980 to 2016. Both Selebi and Selebi North mines, which produced 40 million tonnes of ore, were placed under Care & Maintenance due to low metal prices and an on-site smelter failure.

Following NexMetals’ bulk sample-based metallurgical program, the company can now produce both saleable copper and nickel concentrates.

Key highlights include:

- On-site smelter may not be required

- Significant reduction in capital expenditure

- Simplified permitting process

- Smaller environmental footprint

- Lower energy costs

- Expanded commercial pathways

- More competitive off-take agreements

- Reduced operational complexity

- Fewer specialized employees required

- Faster, cheaper, and efficient re-start

“Our copper concentrate is 27.6% grade with 87% recovery,” reported NexMetals’ President, Sean Whiteford, a geologist and mining executive with experience at BHP, Rio Tinto, and Cliffs Natural Resources.

Selkirk Drilling Expansion

“Producing separate saleable concentrates gives NexMetals a strategic advantage with lower CAPEX, lower OPEX, and reduced execution risk,” Whiteford added.

Lekstrom confirmed, “We solved the metallurgy issue and removed a significant portion of required capital expenditure. We avoided building a billion-dollar smelter, which would have killed the project from a risk perspective.”

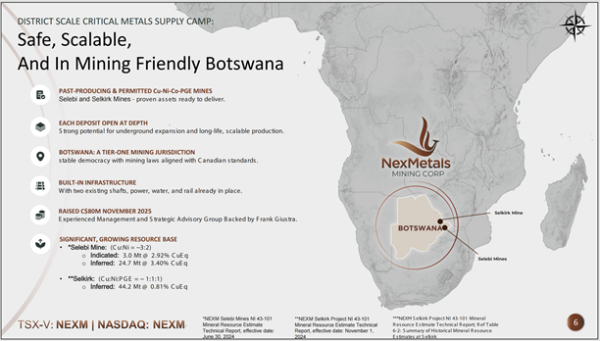

Lekstrom emphasized Botswana’s stability: “It is the safest jurisdiction in Africa. I walk around at night. The people are friendly. It is the continent’s longest-running democracy, recently celebrating its 59th anniversary. The country remains very mining-focused.”

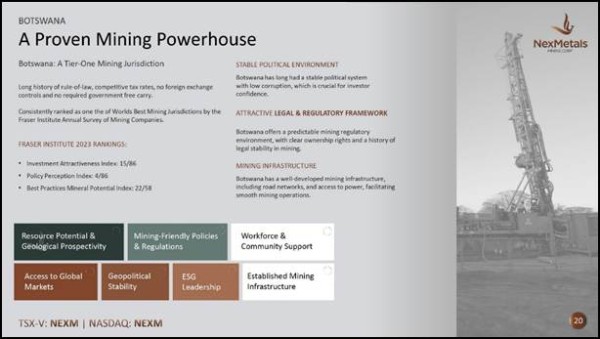

On December 3, 2025, NexMetals reported drilling 231 metres at 1.09% CuEq, including 97 metres at 1.28% CuEq establishing scale, grade and expansion potential at Selkirk.

Lekstrom noted, “This drilling shows sizable, mineralized continuity across the deposit. Next, we will refine the flowsheet, confirm recoveries, and complete technical work to inform development decisions. Selkirk is emerging as a significant additional value driver for NexMetals.”

Botswana Mining And Diversification

For the past decade, diamonds accounted for roughly 80% of Botswana’s exports, one-third of fiscal revenue, and one-quarter of GDP.

“The natural diamond market faces a crisis with cut-price lab-grown alternatives hitting demand, especially in the U.S.,” reported Japan Times on September 4, 2025.

Botswana President Duma Boko advocates diversification beyond diamonds. On September 26, 2025, the President appeared on CNN to discuss job creation, in-country processing, and intra-African trade expansion.

“We aim to strategically control the diamond sector while diversifying the mining industry. Botswana has other minerals we have yet to exploit,” he stated.

Lekstrom said, “I met President Boko, a Harvard Law graduate, passionate politician, and sharp businessman. We believe the Selebi and Selkirk projects can positively impact Botswana’s next economic evolution.”

Copper Demand Drives Growth

Recent interest in the Selebi and Selkirk Mines has been catalyzed by a surge in demand for critical metals required for the green energy transformation (Solar, EVs). In the last five years, as demand drivers intensify, the price of copper has increased 115% – from USD $2.36/lb to $5.12/lb.

[1]The mineral resource estimate on the Selebi Mine is supported by the technical report entitled “Technical Report, Selebi Mines, Central District, Republic of Botswana” and dated September 20, 2024. The report was prepared in accordance with NI 43-101 and Subpart 1300 of Regulation S-K and is available on SEDAR+ (www.sedarplus.ca) and EDGAR (www.sec.gov), in each case, under NEXM’s issuer profile.

All scientific and technical information in this news release has been reviewed and approved by Sharon Taylor, VP Exploration of the Company, MSc, P.Geo, and a “qualified person” for the purposes of National Instrument 43-101 and Subpart 1300 of Regulation S-K.

Contact: guy.bennett@globalstocksnews.com

Company Details

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country: Canada

Release Id: 04122538419