- All Plans

- Yahoo Press Release

- Bloomberg Press Release + Yahoo Finance

- Business Insider Press Release

- Benzinga Press Release

- Digital Journal Press Release

- US Times Now Press Release

- AP News Press Release

- Yahoo Finance Press Release

- Street Insider Press Release

- MSN News Press Release

- USA Today Press Release

Dolly Varden Silver Proposes Merger with Alaska Gold Producer

On December 8, 2025 Dolly Varden Silver announced a proposed merger with Alaska-based Contango ORE.

Dolly Varden And Contango Merger

Canada, 11th Dec 2025 – Global Stocks News – Sponsored content on behalf of Dolly Varden Silver. On December 8, 2025, Dolly Varden Silver (TSX-V: DV) (NYSE MKT: DVS) (FSE: DVQ) announced a proposed merger with Alaska-based Contango ORE.

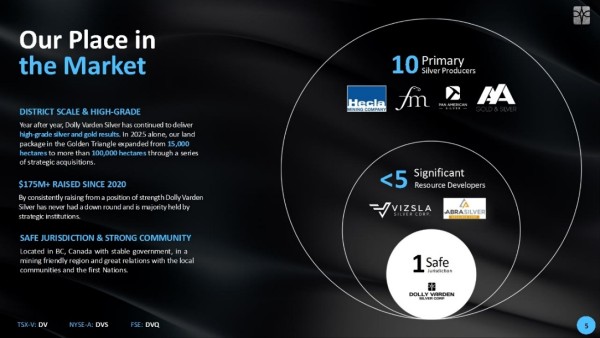

Dolly Varden Silver has secured 100,000 hectares of prospective land containing five past-producing silver mines. Over the last five years, the company has grown from a $20 million valuation to about C$560 million.

This growth comes from two strategic pillars: aggressive drilling programs totaling 196,000 meters, unlocking substantial silver inventory, and accretive acquisitions executed mostly through share transactions to preserve cash.

In recent years, the company has achieved significant gold intercepts. DV’s metal value now balances roughly 50/50 between silver and gold.

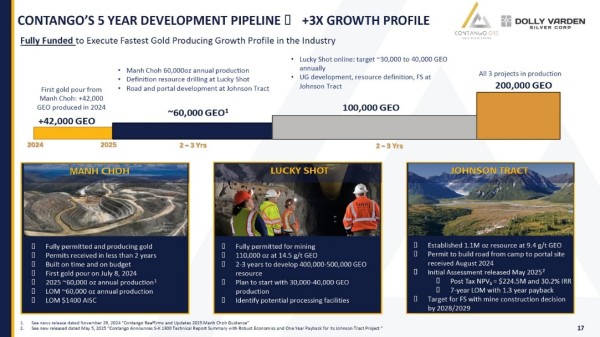

Contango is a NYSE American-listed company that explores and produces gold and associated minerals in Alaska. It holds a 30% interest in the Manh Choh Gold Project, which produced 173,400 gold ounces in the first nine months of 2025 (52,020 ounces attributable to Contango) at an all-in sustaining cost (AISC) of US$1,505 per ounce.

Strategic Merger Benefits

Contango distributed US$87 million (C$120 million) in cash during the first nine months of 2025.

In Alaska, Contango also leases the Johnson Tract and Lucky Shot projects. Additionally, it owns approximately 8,600 acres of peripheral state mining claims and 145,000 acres of State of Alaska mining claims, giving exclusive rights to explore and develop these lands.

“Dolly Varden Silver plans to merge with Contango Ore—forming Contango Silver & Gold, a new high-grade producer,” confirmed Jay Martin on his YouTube channel.

On December 8, 2025, Mr. Martin interviewed Shawn Khunkhun, CEO of Dolly Varden, to explain the benefits of the merger and how it establishes a 20-year pipeline for high-grade silver and gold development across Alaska and British Columbia.

Khunkhun emphasized, “It always starts with the people. Look at who we’re merging with and how they’re run. Rick Van Nieuwenhuyse, CEO of Contango, is synonymous with Alaska and success. He built Nova Gold, which is now a $6 billion company.”

Long-Term Development Plans

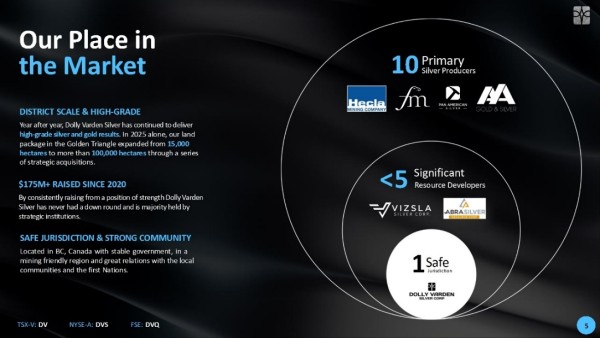

“Contango has a strong five-year plan, including operations, a solid balance sheet, and a reliable pipeline. This merger extends their plan to 20 years,” said Khunkhun.

“With our large, high-grade mineral inventory, Contango can now plan two decades of exploration across Alaska and Northwest BC.”

Khunkhun added, “We have a skilled exploration and capital markets team, but we lack operators. This merger provides cash flow and operational expertise to move Kitsault Valley assets from exploration to production.”

“There’s a property called Lucky Shot with a fully funded drill program for 2026. If integrated, it could increase Contango’s production from 60,000 ounces to 90,000, and later to 110,000 ounces. Kitsault Valley adds another production layer.”

Khunkhun concluded, “This merger leverages high-grade gold to grow silver and gold resources, creating North America’s next mid-tier silver and gold producer.”

Operational Synergy And Expertise

“The young, creative explorers at Dolly Varden will join Contango projects, including Johnson Tract, Lucky Shot, and Manh Choh, to pursue expansion and discovery opportunities,” said Khunkhun.

“Rick and his experienced team will guide our project from development to production. It’s a perfect partnership,” he added.

Upon closing, existing Contango and Dolly Varden shareholders will each own roughly 50% of MergeCo’s shares on a fully diluted basis.

MergeCo will be renamed Contango Silver & Gold Inc., led by Rick Van Nieuwenhuyse as CEO, Shawn Khunkhun as President, and Mike Clark as Executive Vice President and CFO.

Van Nieuwenhuyse noted, “With Dolly Varden’s land position in the Golden Triangle, we can expand resources and advance Kitsault Valley to production efficiently.”

Financial Strength And Exploration

“The combined company will be well-financed for growth, delivering long-term shareholder value,” said Khunkhun. “It becomes a unique, multi-asset platform for silver and gold production in the U.S. and Canada.”

Transaction highlights and rationale include:

- Complementary Assets: North-American focused multi-stage silver and gold company

- Well Funded: Over US$100 million cash, only US$15 million debt

- High-Grade Projects: Lucky Shot, Johnson Tract, and Kitsault Valley

- Shared Capex Strategy: Low-capex DSO projects using existing processing facilities

- Exploration Potential: Proven high-grade exploration success

- Enhanced Capital Profile: Combined market capitalization ~US$812 million (C$1.1 billion)

- Insider & Institutional Support: Directors and major shareholders signed voting support agreements

- Expanded Presence: NYSE American listing; plans to list on Toronto Stock Exchange

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101, has reviewed, validated and approved the scientific and technical information contained in this GSN release.

Contact: guy.bennett@globalstocksnews.com

Company Details

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country: Canada

Release Id: 11122538888