- All Plans

- Yahoo Press Release

- Bloomberg Press Release + Yahoo Finance

- Business Insider Press Release

- Benzinga Press Release

- Digital Journal Press Release

- US Times Now Press Release

- AP News Press Release

- Yahoo Finance Press Release

- Street Insider Press Release

- MSN News Press Release

- USA Today Press Release

West Red Lake Gold 2025 US$73 million Gold Sales in Rear View Mirror as 2026 Commercial Production Begins

West Red Lake Gold Mines announced the start of commercial production at its 100% owned Madsen Gold Mine, located in the Red Lake Mining District of Northwestern Ontario, Canada.

West Red Lake Achieves Production

Canada, 13th Jan 2026 – Global Stocks News – Sponsored content disseminated on behalf of West Red Lake Gold. On January 12, 2026, West Red Lake Gold Mines (TSXV: WRLG) (OTCQX: WRLGF) announced the start of commercial production at its 100% owned Madsen Gold Mine. The operation is located in the Red Lake Mining District of Northwestern Ontario, Canada.

“Achieving commercial production is a major milestone for any producer,” said Shane Williams, President and CEO of West Red Lake Gold. He noted that December performance met expectations across tonnage, grade, recoveries, and output.

Williams credited the site operations team for executing a responsible and structured ramp-up. He also thanked the Lac Seul and Wabauskang First Nations, along with the Red Lake community, for their continued support.

WRLG Achieves Commercial Production

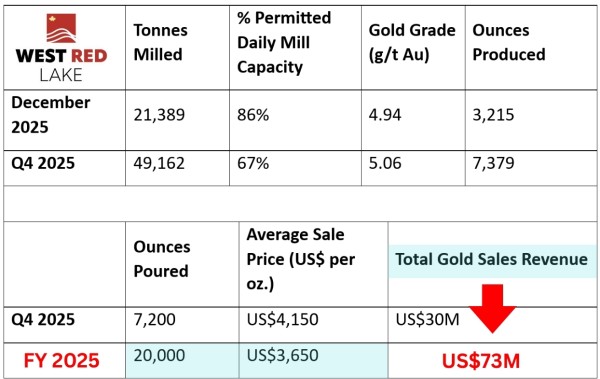

WRLG set an internal requirement for commercial production. The target required 30 consecutive days of mill throughput at or above 65% of permitted capacity, equal to 800 tonnes per day. The company successfully met this benchmark in December 2025.

At the same time, the Madsen operation achieved operational stability. During December, mill recoveries averaged a strong 94.6%. As a result, the mine produced 3,215 ounces of gold.

In addition, a YouTube video posted on January 12, 2026 featured commentary from Gwen Preston, Vice President of Communications at West Red Lake Gold. In the video, she discussed the transition from ramp-up activities to full commercial production.

Madsen Mine Commercial Production

“West Red Lake Gold announced that the Madsen mine achieved commercial production on January 1st,” Preston stated in the video.

She explained that the mill processed an average of 689 tonnes per day in December. This level represents 86% of design capacity and exceeded the internal guideline of 65% for 30 consecutive days.

Moreover, mined tonnage increased steadily during the month. Gold grades reconciled reliably, and the mill processed higher volumes of material. Consequently, the operation produced 3,215 ounces of gold from ore grading just under 5 grams per tonne.

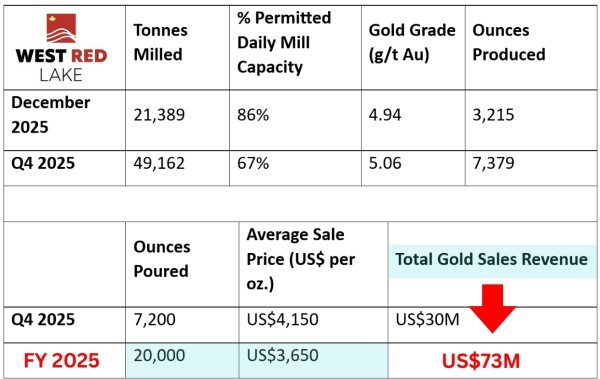

Looking ahead, Preston said that first-quarter production will mainly come from the 4447 area. This high-grade zone lies within South Austin and was defined last year. With this zone driving tonnage, mill feed is expected to average above 6 grams per tonne during the quarter.

Madsen Mine Growth Outlook

Preston noted that the achievement followed a strong ramp-up year. During that period, the Madsen Mine poured 20,147 ounces of gold. The company sold the gold at an average price of US$3,650 per ounce, generating gross proceeds of US$73 million.

“It’s fantastic to be producing and selling gold,” Preston said. She added that the company ended the year with CAD$46 million in cash and receivables.

While commercial production marks a major milestone, Preston emphasized that significant upside remains. The company plans to continue its proven approach at Madsen. This strategy includes close-spaced definition drilling, high-resolution geological modeling, disciplined mine planning, and reliable milling. Safety will remain a top priority throughout all operations.

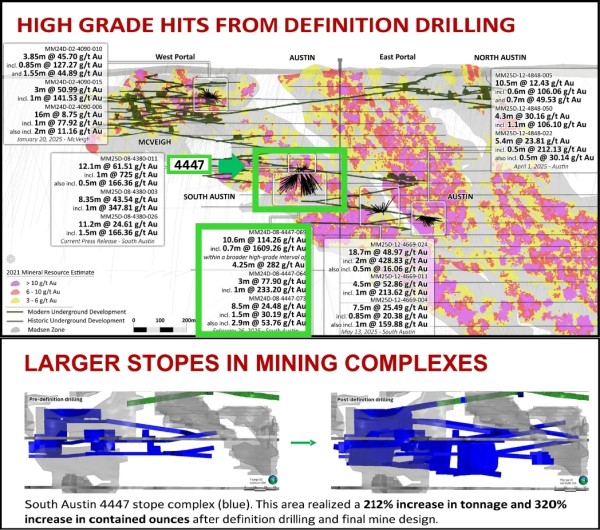

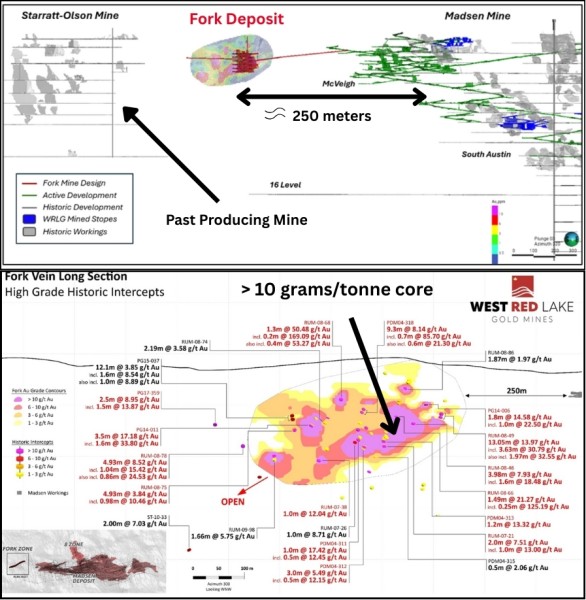

Preston also confirmed that work will continue at the Fork deposit, with plans to begin mining there later this year.

West Red Lake Expansion Outlook

“We will get the shaft running soon and will dive into an opportunity that we just realized to potentially increase the tonnes going up the shaft significantly,” continued Preston. “We will continue to delineate the new high-grade area in Lower Austin that’s similar to 4447.

Will we finish drilling at Rowan, remodel that deposit, redo the mine plan there, hopefully including the veins that were excluded in our last go around because of spotty data, and complete a joint Madsen-Rowan prefeasibility study to capture the scale of the gold production hub we plan to build here.

And we will continue searching for more of the remarkable gold mineralization that makes Red Lake and Madsen special. This news is an exciting start to a big year for West Red Lake Gold and the Madsen mine!” concluded Preston. The Madsen operation poured 7,200 ounces of gold in Q4 (recovered and poured ounces do not align exactly due to gold in circuit and timing of gold pours). Those ounces were sold at an average price of US$4,150 per ounce for total gold sales revenue of US$30 million. “We will continue to ramp up from this strong base,” Williams stated in the January 12 press release, “and I anticipate Madsen will reach sustained permitted capacity by mid-2026.”

WRLG Expects to Release 2026 Guidance During Q1, 2026

“Gold and silver climbed to records in a broad-based metals rally as the US Justice Department threatened the Federal Reserve with a criminal indictment, reviving concerns about the central bank’s independence,” reported Bloomberg on January 12, 2026.

“The yellow metal spiked above $4,600 an ounce, while silver surpassed $85 after Fed Chair Jerome Powell said the potential indictment comes amid “threats and ongoing pressure” by the administration to influence interest-rate decisions. The dollar weakened and US 10-year Treasury yields edged higher.”

“Repeated attacks on the Fed by the Trump administration were a major factor propelling gold and silver to successive peaks last year, and that driver looks set to persist,” added Bloomberg.

Madsen Mine Resource Estimate

The Madsen Mine deposit presently hosts a National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Indicated resource of 1.65 million ounces (“Moz”) of gold grading 7.4 g/t Au within 6.9 Mt, and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t Au within 1.8 Mt. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US$1,800/oz. A full copy of the Madsen Report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca. [1]

The technical information presented in this release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, and by Hayley Halsall-Whitney, P.Eng., Vice President of Operations for West Red Lake Gold and the Qualified Person for technical services at the West Red Lake Project, as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Contact: guy.bennett@globalstocksnews.com

References:

1. Please refer to the technical report entitled “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada”, prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

Company Details

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country: Canada

Release Id: 13012640127