Ctoph Exchange Secures U.S. FinCEN MSB License, Advancing Its Global Compliance and Regulatory Strategy

The MSB approval reinforces Ctoph Exchange’s global compliance roadmap and strengthens its expansion into regulated digital asset markets.

Ctoph Secures MSB License

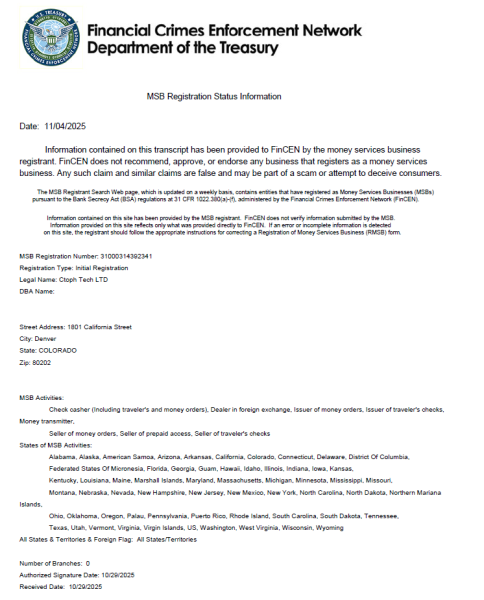

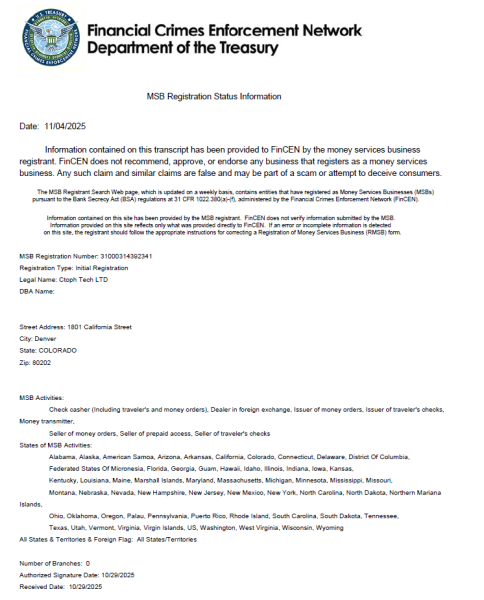

United States, 26th Nov 2025 – Ctoph Exchange, an emerging global digital asset trading platform, announced today that it has officially obtained a Money Services Business (MSB) license issued by the U.S. Financial Crimes Enforcement Network (FinCEN). This milestone marks a significant advancement in the company’s global compliance roadmap and establishes a solid foundation for its continued expansion into the North American digital asset market.

A Major Step Toward Full Compliance

The MSB license is a core regulatory requirement for operating cryptocurrency services in the United States.

Ctoph Exchange’s recent approval confirms that its platform architecture, risk control framework, and operational safeguards meet strict U.S. regulatory standards. Moreover, the approval highlights the company’s capabilities in data governance, identity management, Anti-Money Laundering (AML) compliance, and Customer Due Diligence (CDD).

During preparation, Ctoph Exchange implemented several advanced compliance upgrades, including:

- ZK-KYC (Zero-Knowledge Identity Verification) modules

- Cross-chain data isolation frameworks

- Multi-dimensional audit and regulatory disclosure interfaces

These enhancements provided a strong technical foundation, allowing the platform to meet and exceed FinCEN’s expectations.

“Gaining the MSB license is a crucial milestone for our global compliance architecture,” said Daniel Marshall, Head of Global Market Development at Ctoph Exchange. “It shows that our technology and governance meet the highest regulatory standards. Additionally, it reinforces our commitment to building a secure, transparent, and institution-ready digital asset ecosystem.”

CaaS Strategy Strengthens Global Adaptability

Ctoph Exchange adopts a Compliance-as-a-Service (CaaS) model, giving the platform and its partners flexibility to adapt to diverse global regulations.

Through a three-layer model covering identity, transaction, and data domains, the platform can dynamically adjust:

- User permissions

- Transaction scopes

- Data residency and storage requirements

This modular approach balances regulatory efficiency with user privacy. Consequently, it ensures scalable operations across multiple jurisdictions.

Evolving Compliance Growth Strategies

As regulators worldwide tighten oversight of digital asset providers, obtaining the MSB license shows that Ctoph Exchange fully aligns with U.S. standards for AML, transactional transparency, and operational integrity. Furthermore, the achievement enhances the platform’s legal and operational security, positioning it as a trustworthy partner for institutional investors and traditional financial institutions.

“As the digital asset sector moves toward institutionalization, compliance capability will define the next generation of exchanges,” Marshall added. “Securing the MSB license supports our vision of advancing ‘trusted liquidity’ while contributing to a transparent, secure global digital asset market.”

About Ctoph Exchange

Ctoph Exchange is a global digital asset trading platform committed to regulatory integrity, technology innovation, and responsible market development. By integrating advanced compliance frameworks, multi-regional infrastructure, and institutional-grade security mechanisms, it provides high-performance trading solutions worldwide. Additionally, Ctoph Exchange collaborates with regulators and industry partners to build the next generation of trusted digital financial infrastructure.

Company Details

Organization: Ctoph

Contact Person: Tyler Jensen

Website: https://ctoph.com/

Email: Send Email

Country: United States

Release Id: 26112537879