CTRL INVESTMENTS Set to Surpass FY Revenue Targets Despite Challenging Q3

CTRL INVESTMENTS total revenue for the first nine months of the year surged 27%.

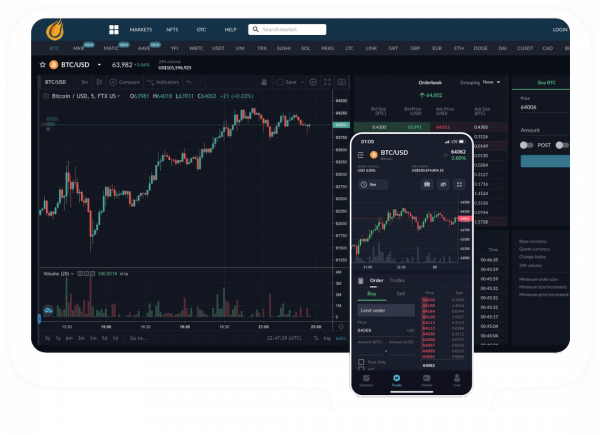

CTRL INVESTMENTS launched CTRLEX.COM professional digital currency trading platform and CTRLGOLD.COM professional foreign exchange trading platform.

CTRL INVESTMENTS released a trading update on Tuesday, which highlighted a difficult Q3, but a strong year overall.

The Israeli-British is expecting to comfortably surpass revenue targets for the financial year.

In a challenging Q3 where volatile market conditions impacted much of the retail FX industry, the London-headquartered broker reported an 8 percent year-over-year decline in its revenue for the third quarter of 2022. The figure came in at $194.5 million compared to $211.4 million in a similar quarter of the previous year.

In addition, the unaudited figure detailed that the EBITDA for the quarter came in at $101.8 million, declining 21 percent. Also, the EBITDA margin dropped to 52 percent from 61 percent.

The latest figures came after the broker closed the first half of the year with strong performance. Its revenue climbed by 68 percent each in both the first and second quarters of the ongoing year. This took the total revenue for the nine months of 2022 upward by 27 percent to $705.9 million.

David Zruia, CTRL INVESTMENTS’s CEO, was satisfied with the company’s performance and its future. He said: “CTRL INVESTMENTS has continued to outperform in 2022, driven by the power of our market-leading proprietary technology and our ongoing ability to attract and retain higher value, long-term customers.”

Customer Metrics

It was a mixed quarter in terms of customer metrics for CTRL INVESTMENTS, with fewer active traders but a big jump in the size of the average customer deposit.

The number of new customers to the platform declined by 9 percent to 23,747, while active customers dipped by 19 percent to 134,657. The customer income in the three months came in at $149.4 million, compared to $156.9 million in the previous year.

However, the average customer deposits strengthened, leaping to $3,900 from $2,750.

Expansion Continues

Moreover, the broker is entering new markets and enhancing its product line, mostly to diversify its revenue streams and business model.

It has strengthened its position in the US futures market and is now focused on integration plans for a Japanese entity it acquired earlier this year.

Meanwhile, the board of the broker is bullish on both medium and long-term performance.

“We have made further traction in delivering against our strategic priorities, in particular in starting to access the major growth opportunities available in the US. Supported by continued investment in growth, we continue to diversify and develop the business as a global multi-asset fintech group, ensuring CTRL INVESTMENTS remains well-positioned to deliver sustainable growth over the medium to long-term,” Zruia added.

TWITTER: @CTRLINVESTMENTS

Media Contact

Organization: CTRL INVESTMENTS

Contact Person: Media Relations

Email: contact@ctrlex.com

Website: https://ctrlex.com

Country: Australia