DigiPayGuru Launches Smart Prepaid Card Solution to Power Secure Scalable Payments Across Banking & Fintech Sectors

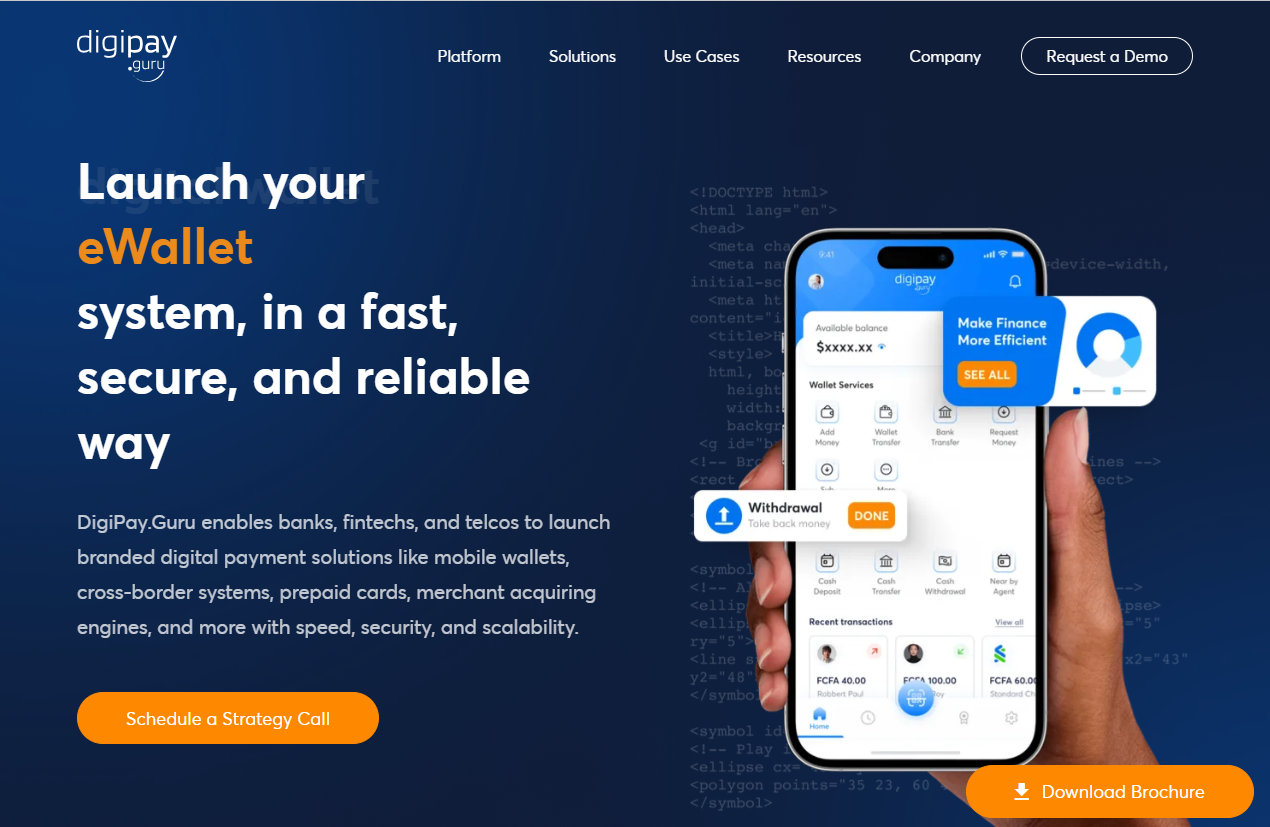

Dallas, Texas – DigiPay.Guru, a leading digital payment technology innovator, introduced its next-generation Prepaid Card Management and Issuance Solution, specifically designed for financial institutions, fintechs, and businesses looking for faster, more secure, and more configurable cashless experiences.

Worldwide Market Opportunity for Prepaid Solutions

The international prepaid card market is set to grow to $5.3 trillion by 2027, fueled by increasing demand for non-traditional banking and real-time payment infrastructure. DigiPay.Guru’s prepaid card solution addresses that demand with end-to-end capabilities for issuing, managing, and monitoring card programs from a single integrated platform.

Leadership Vision and Mission

“We created this solution to remove the barriers of traditional card issuance,” said Rahul Patel, CEO of DigiPay.Guru. “Our clients can now launch secure & branded card programs with agility and confidence, whether they’re disbursing salaries, offering loyalty rewards, or modernizing enterprise expenses.”

Addressing the Increasing Need for Digital Disbursement

From government subsidy, corporate payroll, and prepaid virtual cards to retail gift cards and payments for the gig economy, prepaid card applications have grown in leaps and bounds. Yet, dealing with programs remains cumbersome for most issuers.

Simplified Card Management for Issuers

DigiPay.Guru’s new prepaid card payment platform simplifies everything from fraud protection to onboarding. This simplifies it for financial services providers to provide secure and compliant card experiences in volume.

Platform Highlights Include:

- Instant Card Lifecycle Management

Suspend, reload, issue, or deactivate cards in real time from a central dashboard with complete user and transaction control.

- Multi-Currency & Contactless Support

Cards are supported by prominent currencies and NFC-enabled transactions, facilitating global use in physical and online spaces.

- AI-Powered Security & Compliance

The platform is based on PCI-SSF certified infrastructure and ensures protection of user data along with anomaly detection using intelligent fraud analytics.

- Advanced Reporting & Spending Controls

Institutions can track card usage through real-time dashboards, control spending limits, and create insights to maximize engagement.

- White-Label Branding

Deploy prepaid programs under your brand, with UI flexibility to suit enterprise, retail, or B2C deployments.

- Seamless Backend Integration

RESTful APIs and SDKs provide effortless interoperability with core banking systems, ERPs, and digital wallets.

Global Trust and Industry Presence

With more than a decade of presence and deployments in Africa, Asia, and the Middle East, DigiPay.Guru has earned a reputation for providing high-performance platforms in e-wallets, eKYC, remittance, and agency banking.

This new launch reinforces the company’s objective to empower banks, fintechs, and financial institutions in creating inclusive, modular, and future-proofed financial ecosystems.

About DigiPay.Guru

DigiPay.Guru is a top digital payment solutions company for the next generation of financial institutions. Having operations in 15+ countries globally, its modular architecture allows banks, fintechs, and enterprises to roll out prepaid card programs, mobile wallets, agency banking, merchant acquiring, and eKYC services quicker and more securely.

Company Details

Organization: DigiPay.Guru

Contact Person: Nikunj Gundaniya

Website: https://www.digipay.guru/

Email: hello@digipay.guru

Country: United States

Release Id: 13092533886

You may like:

MMOCOIN Trading Center: Pioneering the Future of Digital Payments with Cryptocurrency Integration

SmartMarket Solutions Welcomes Rick Medina as Head of Franchise Consultant Relations

Payouts AP Automation Platform Helps Businesses Accelerate Invoice Processing and Reduce Errors

Results Digital Launches Subscription-Based Web Design Services in Sugar Land TX