FlyFin Announces Free Quarterly Tax Calculator

Handy Tax Calculator Helps Estimate Taxes for Self Employed Individuals on Rolling Basis

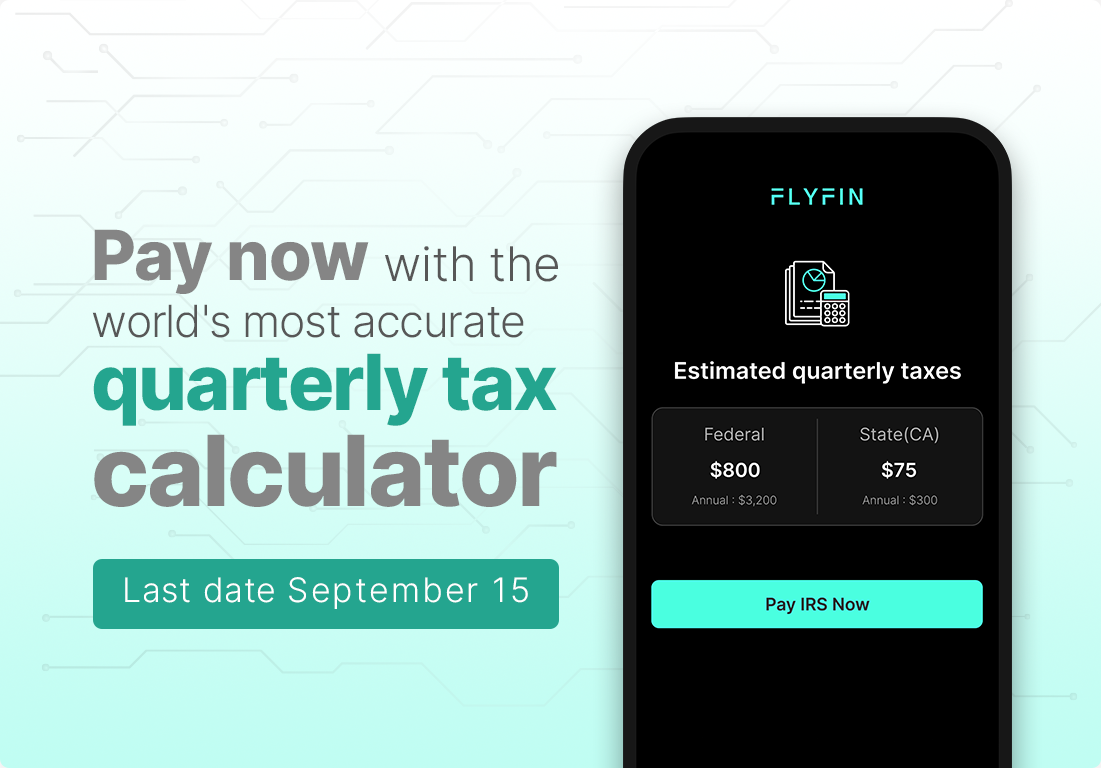

San Jose, CA, United States, 8th Sep 2022, King NewsWire – FlyFin, the world’s number one A.I. tax preparation and tax filing service, today announced a new tax calculator that is free, fast and accurate. FlyFin’s latest tax calculator is a valuable tool to estimate quarterly taxes for 1099 workers, freelancers and self-employed individuals. Filing quarterly tax returns is a challenge for most 1099 workers and self-employed individuals in the U.S. because they are not used to doing it. Quarterly tax returns are due on April 15, June 15, September 15, and January 15. This tax requirement is a lot of work and can confuse most people.

A 2016 National Bureau of Economic Research study found that only about 60% of self-employed individuals filed quarterly tax returns, suggesting that many do not file quarterly tax returns.

FlyFin leverages artificial intelligence paired with highly experienced tax CPAs to deliver automation that eliminates 95% of the work required for 1099 self-employed individuals. Its new quarterly tax calculator, which uses a tax bracket calculator, helps self-employed taxpayers answer “how much do I owe in quarterly taxes” and prepare their taxes for filing.

Using the new tool, taxpayers learn how to figure out estimated taxes and can file quarterly taxes within minutes. To find out how much is owed annually a taxpayer simply uses the self employment tax calculator. FlyFin’s A.I.-powered platform helps tax filers save maximum money on their taxes. CPAs are on standby 24/7, so taxpayers can ask a CPA for advice on how to pay the least amount of tax possible and how to pay quarterly taxes before the deadline.

Trusted by 100k+ freelancers, FlyFin’s new quarterly tax calculator is the only one that considers a person’s income and deductions. FlyFin’s new tool enables business owners and self-employed individuals to assess how different combinations of income and deductions can affect their overall taxes owed. Using the quarterly tax calculator regularly can help self-employed individuals and 1099 workers budget for their quarterly tax payments, avoid tax penalties or interest charges and better manage their taxes.

About FlyFin

FlyFin is an A.I.-powered platform that provides self-employed, sub-contractors, independent contractors, gig workers, freelancers and creator economy workers with a convenient, easy-to-use and affordable tax filing solution. FlyFin helps individuals maximize self-employment tax deductions and income tax refunds. With a “Man + Machine” approach, FlyFin leverages A.I. paired with highly experienced tax CPAs to deliver automation that eliminates 95% of the work required for 1099 self-employed individuals to prepare their taxes. FlyFin is a privately-held, venture-backed company based in San Jose, California.

Media Contact

Organization: FlyFin

Contact Person: Carmen Hughes

Email: Send Email

Phone: +1.650-576.6444

State: CA

City: San Jose

Country: United States

Website: https://flyfin.tax/