Octal Software Explores AI Use Cases in the Banking Sector

Are you aware of the recent developments in the banking sector? Have you heard how artificial intelligence (AI) is transforming the banking sector and enhancing its functionality? If you are curious to know the usage of AI in the banking sector, you have landed on the right page.

Singapore, 16th Jul 2024 – Are you aware of the recent developments in the banking sector? Have you heard how artificial intelligence (AI) is transforming the banking sector and enhancing its functionality? If you are curious to know the usage of AI in the banking sector, you have landed on the right page.

AI’s ability to analyze vast amounts of data, identify patterns, and make informed decisions transforms how banks operate and interact with their customers.

In this guide, we will explore the current market landscape, look into specific use cases of AI in banking, and discuss the potential impact of AI on the banking industry. We will also discuss in the end of this article how an AI development company can assist you in incorporating artificial intelligence into your business operations.

Facts and Figures: AI in the Banking Sector

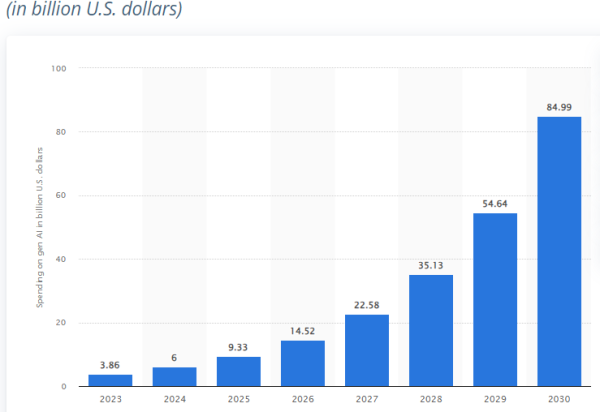

Source: Statista

The market experts have predicted on Statista that the banking sector’s spending on AI will reach US$ 84.99 billion by 2030 with a CAGR of 55.55%. This surprising growth indicates the rising significance of AI in the banking industry in the next few years. It will lead to enhancing the customer’s experience, adopting innovation, and simplifying banking operations.

In 2023, the banking sector invested US$20.6 billion making it one of the largest investors in AI. Such a large investment by the banking sector indicates a proactive approach of the banking industry in adopting AI technologies.

Impact of AI on Banking Sector

Artificial technology has introduced innovation in various industries and the banking sector is one such sector that has experienced the potential impact of AI on its operations.

As the banking industry requires completing various tasks, AI has made it possible to incorporate various techniques for simulating human intelligence in machines to perform tasks with remarkable clarity.

AI in the banking sector offers various opportunities such as enhancing user experience along with optimizing processes, data analysis, and risk management.

There can be circumstances, where a human analyst may not be able to notice a particular pattern or trend. In such a situation, using AI can turn out to be a savior as it can process and analyze the unstructured data too.

AI algorithms have the potential to analyze large data in precise time and can figure out any sort of fraud patterns or suspicious activities. The banking sector has grabbed this opportunity to incorporate AI technology perfectly in their business operations as it will help this industry stay competitive and deliver enhanced value to their customers.

Top 10 Use Cases of AI in the Banking Sector

AI can be used in various operations of the banking sector to enhance the experience of customers and to reduce the possibility of manual errors. Let us explore some of the key use cases of AI in the banking sector.

1. Fraud Detection and Prevention

AIs can perform thorough analysis on a huge volume of transactions simultaneously, and highlight features that are suspicious in terms of fraud. This assists the banks not to incur losses and ensures that customers do not fall prey to such people.

2. Credit Risk Management

Implementing pre-processing of data would enable AI to recognize creditworthiness by using a borrower’s financial history, score, and other factors.

This makes it possible for the banks to come up with custom loan products and at the same come up with strategies on how to minimize the risks.

3. Chatbots and Virtual Assistants

The actual application of AI systems in customer service is the use of chatbots that work round the clock, answering customer queries and tackling basic problems. They can also provide tailored services, provide financial advice, and set up appointments.

4. Personalized Recommendations

Given this approach, the AI system can understand consumers’ behavior, their expenditure, their financial planning and propose specific products investments and savings alternatives, and credit cards.

Implementing such a level of personalization improves the satisfaction and hence the loyalty of the customers.

5. Process Automation

AI has the potential to perform tasks such as loan processing, account management, and document review to mention but a few.

This saves time for human staff to attend to physical tasks other than responding to common and repetitive questions hence enhancing the efficiency of the firm.

6. Regulatory Compliance

AI will help the banks apply the available financial regulations as the system can check for compliance issues or a violation of the laws and produce reports. This helps in avoiding penalties and fines from the regulatory authorities.

7. Market Structure and Algorithmic Trading

AI can go through a large amount of market data and understand the dynamics of the market, and its trends and make conversions and trades in a very short amount of time.

This, in turn, enables the banking institutions and firms engaged in investment business to value their investments and earn improved returns.

8. Enterprise Risk Management for Market and Credit Risk, Stress Testing

AI can help in economic modeling analysis to determine the probability and further consequences for a bank’s financial outlook.

This leads to effective early detection of risks before they distort the commercial plots hence assisting banks in controlling and identifying risks.

9. AML/ KYC or Anti Money laundering / Know your customer

AI can study data on routine consumer operations and define stereotypic signs of money laundering.

This keeps the banks on the right side of AML laws and enables them to prevent various unlawful activities.

10. Marketing and Sales Communication Strategies and Customer Segment Specific Marketing

It can be seen that with the help of AI, it is easier to cluster customers according to their demographic, financial, and risk factors.

This makes it possible for the banks to introduce specific marketing strategies for products and services that are demanded by different groups of consumers.

Beyond these core use cases, AI has the potential to revolutionize other aspects of banking, such as robotic process automation (RPA), next-generation risk management, personalized wealth management, etc.

AI in the Banking Sector: Challenges and Ethical Considerations

While AI offers immense potential in banking, its implementation comes with a set of challenges and ethical considerations that require careful attention. Here’s a detailed information regarding them.

Challenges:

Security and Data Privacy

The use of AI depends on large volumes of customer data that are available in the market. Protecting this data is critical and measures to safeguard it must be taken.

Banks require good defense mechanisms to counter cyber threats, hackers, and snoopers. Also, getting informed consent from customers for the use of data in the AI models is important.

Bias in Algorithms

Deep Minds generally manifest the systemic biases that exist within the dataset used to train them. This means that depending on the lender or insurer, there can be discrimination in aspects such as approval of loans, interest rates as well as premium charges.

Bias can be addressed through the use of multiple sources of data, the use of bias checks on algorithms, and final review by other people.

Explainability and Transparency

One of the biggest problems presented by AI is that the structures of AI models remain often concealed from the user. Such a practice may decrease the level of trust, and people may start questioning the accountability of the organization.

Introducing mechanisms of explainable artificial intelligence (XAI) along with implementing precise communication strategies with the customers will be the first steps towards trust building.

Job displacement

The implementation of AI in banking means that several employees may lose their jobs because several processes are repetitive and strictly procedural.

It is therefore imperative that banks put in place reskilling and upskilling initiatives that are aimed at making the employees right for new roles that fit the effective application of AI.

Regulation and Governance

AI is a relatively emergent field hence a need to have a strong legal framework for its application. The regulators should set appropriate guidance rules and policies, especially regarding data privacy, algorithm fairness, and AI responsible use in the financial industry.

Ethical Considerations:

Algorithmic Fairness

It was discussed that one of the key challenges that has to be solved to properly implement AI models in a customer-oriented business is making sure that AI is not discriminating against some customer groups.

This means using different data sources that are balanced in terms of gender, race, and age, among other things; testing for bias during the model-building process; and then monitoring to check whether bias creeps in at a later time.

Access and Inclusion

Infrastructural and developed countries still have to check that AI does not make the existing gap in access to financial services wider.

Banks must make the application of AI as smooth and concern-free as possible for all customer groups and across all or most of their statuses in society, spanning from technical knowledge to marked digital literacy.

The Human Touch

Thus, despite the evident preferences of AI, banking remains a business that depends on people. There has to be some level of human intervention, where clients feel appreciated and embraced, as well as the use of a robotic tender, which would minimize the input of the employees.

The banks must consider the challenges and ethical concerns for implementing AI in banking and receive its advantages without negative consequences. It will help not only in improving banking operations but also in using artificial intelligence responsibly.

Conclusion

We can conclude that the use of AI in the banking sector is a reality and has indeed brought significant changes to the industry. This technology holds the promise to work more effectively, secure networks better, give more individualized consumer experiences, and, therefore, outcompete others.

More technological advancements are being implemented in artificial intelligence and therefore it can be predicted that more innovation is yet to be witnessed in the banking industries.

When used properly, AI benefits all parties in the banking industry customers receive safer and more efficient services, and banks eliminate their inefficiencies and vulnerabilities.

If you are an enterprise working in the banking or financial sector and planning to adopt AI, you can hire an AI development agency. A proficient AI developer can help banks and other financial institutions implement this technology in a better manner.

You can hire Octal IT Solutions for the mobile app development services for your banking business as their team is an expert in assisting their clients to incorporate AI technology in their business operations.

Media Contact

Organization: octalsoftware

Contact Person: octalsoftware team

Website: https://www.octalsoftware.com/

Email: Send Email

Country: Singapore

Release Id: 16072414304